Below is listed a chart of all the exemptions allowed for Mississippi Income tax. Mississippi allows certain exemption amounts depending upon your filing status and other criteria. Enter the word "deceased" and the date of death after the decedent's name on the return. A return for the deceased taxpayer should be filed on the form which would have been appropriate had he or she lived. You must file a return for the taxpayer who died during the tax year or before the return was filed.

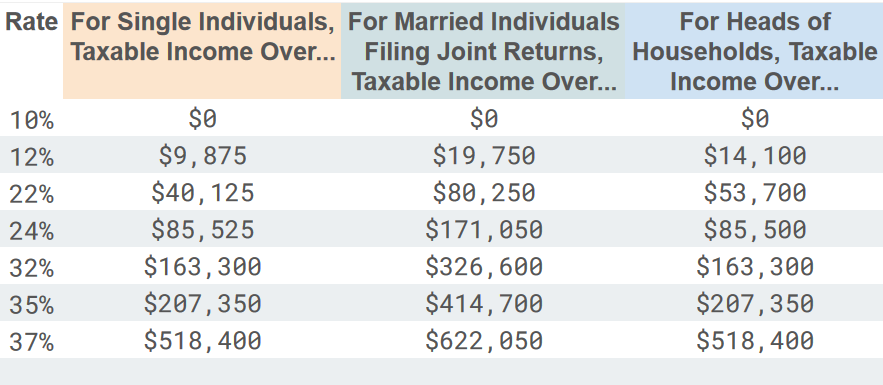

Current 2022 tax brackets plus#

You are a married resident and you and your spouse have gross income in excess of $16,600 plus $1,500 for each dependent.You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent.You must file a Mississippi Resident return and report total gross income, regardless of the source. You are a Mississippi resident working out of state (employee of interstate carriers, construction worker, salesman, offshore worker, etc.).Your total gross income is subject to Mississippi Income tax. You are a Mississippi resident employed in a foreign country on a temporary or transitory basis.

You are a Non-Resident or Part-Year Resident with income taxed by Mississippi.You have Mississippi Income Tax withheld from your wages.

You should file a Mississippi Income Tax Return if any of the following statements apply to you:

0 kommentar(er)

0 kommentar(er)